BBC < link

"Moody's said the government's debt reduction programme faced significant "challenges" ahead."

Three factors come into play when countries are rated.

But in short, it shows how likely any investor - be it company or government bonds - can expect his invested money back.

Tradionally people/ companies invest in bonds as they tend to be more stable and less subject to ups and downs in the financial market. The down side is that the turn out (investment plus contracted interest) is lower than high(er) risk investments.

Governments issue bonds in order to help them cope with their deficit, so to even their national balance.

The government debt (national debt, public debt) is the debt any govenrment owes to others and have to be paid back.

To get an insight of national debt I used database Datastream, went looking for (national) economics data. Search term debt, and as a source I both checked Eurostat and IMF World Economic Outlook.The fig shows figures from IMF.

The outome looks like this

Government deficit is the amount of balance between income/ expenditure of any government. If the balance is in the plus, debt will decrease as the can be redeemed, if it is in the minus, debt will grow.

When the government balance isn't in the black or deep in the red govenrment debt will grow. The likeliness that a government will be able to pay his due decreases.

Investors become more and more concerned about their investments or became reluctant to make any in government bonds.

So a govenrment has to promise to pay back a higher interest in order to attract investors. This results in higher interest rates.

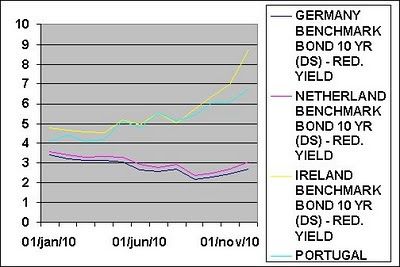

Now, there is the rule of thumb that once interest exceeds 7% a government won't be able to pay back his debt. In the international financial world this is the moment when the international community urges the government to austerity and take harsh measures are urged / forced in order to get things back in order. We only need to thin kof Greece.

Bonds in a country threaten to be marked as junk bonds. (very high interest, but the likeliness of getting your money back is low)

(fig: long term interest rates)

Weblecture on country ratings

Benchmark bonds (10y) 10Y Benchmark bonds are related to the interest rates and so an indication of any country's health. In Datastream benchmark bonds can, therefore, be found in Interest rates, instead of Bonds & Convertibles.

What the CRA (Credit rating Agencies) like Moody's, Fitch and S&P do, is base their judgement on the factors mentioned above. But you could also say, thet if a CRA downgrades a country, that it will have a negative effect on its national economoy.

In other words: Credit ratings feed their own downgrading.

And is a country supposed that spiral downward?

It's one of the reasons that some people claim that CRAs should be banned, or at least, given much less credit (pun) than they are granted now.

Links

Euro countries in distress

S&P Sovereigns rating list

Country rating chart

The Guardian : How CRAs rate countries