RETURN

Compustat North America

Fundamentals annual No

PRCC_C -- Price Close - Annual - Calendar

PRCC_F -- Price Close - Annual - Fiscal

AJEX

But no TRFD

Security daily No

Use

Needed data types PRCCD, AJEXDI, TRFD

((PRCCD / AJEXDI) * TRFD)t) / ((PRCCD / AJEXDI) * TRFD)t-1) * 100

Source WRDS: ((prccd/

ajexdi )* trfd )[ current ] /( prccd/ ajexdi )* trfd ))[ prior time

period ]-1)*100)

Compustat Global

Fundamentals annual. No

Security daily

Price:Yes

Needed data types PRCCD, AJEXDI, TRFD

((PRCCD / AJEXDI) * TRFD)t) / ((PRCCD / AJEXDI) * TRFD)t-1) * 100

source WRDS: ((prccd/

ajexdi )* trfd )[ current ] /( prccd/ ajexdi )* trfd ))[ prior time

period ]-1)*100)

CRSP

Stock/ security files >

Monthly stock file

No total return

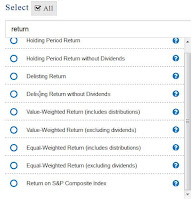

This is what looking for return provides:

Daily Stock File

Looking for returns results in similar downloadables.

Conclusion: CRSP is not a good medium for return data

CRSP/ Compustat Merged

Fundamentals annual: No

Security daily: Yes

Needed data types PRCCD, AJEXDI, TRFD

((PRCCD / AJEXDI) * TRFD)t) / ((PRCCD / AJEXDI) * TRFD)t-1) * 100

MARKET VALUE

Compustat North America

Fundamentals annual: Yes

MKVALT

Security daily: No.

Use PRCCD * CSHOC = Price Closing daily * Common shares outstanding

Compustat Global

Fundamentals annual: No

No price data either

Security daily: No

Use PRCCD * CSHOC = Price Closing daily * Common shares outstanding

CRSP

Monthly stock file: No

Use Price * Number of Shares Outstanding = PRC * SHROUT

Daily Stock File: No.

Use Price * Number of Shares Outstanding = PRC * SHROUT

CRSP/ Compustat Merged

Fundamentals annual Yes

MKVALT -- Market Value - Total - Fiscal

Or

Price close

PRCC_C -- Price Close - Annual - Calendar

PRCC_F -- Price Close - Annual - Fiscal

CSHO -- Common Shares Outstanding

Market value: Price * Shares outstanding

Security daily: no

Use PRCCD * CSHOC = Price Closing daily * Common shares outstanding