Key Elements 10K

- The 10-K is generally more detailed than the annual report,. It doesn't have a PR component, it is mandatory, if the company is publicly traded and is traded in the US

- Publicly traded companies will complete both annual report and 10K

- Both deal with financial performance over the last year of the company

- The 10-K can be found on the SEC website, while the annual report should be readily available on the company’s website.

- Source Investopedia

!! Publicly traded companies in the US << the SEC tneeds to know their finances: 10-K.

What Is an Annual Report?

There is much more flexibility in an annual report, particularly if your business is small. An annual report is a document a company prepares each year to detail its performance.It can also be dressed up for PR's sake.

Most investors get hold of Annual report and not on 10K. Some comps choose to send 10K to both Sec and shareholders.

Components of a 10-K

There are five major components of a 10-K, with businesses personalizing each of those sections with their own information.1. Overview of the business

2. Risk factors

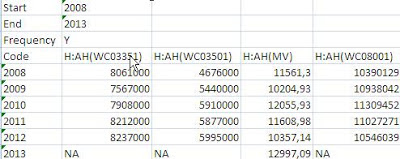

3. Five-year overview of its financial data

4. Management’s Discussion and Analysis of Financial Condition and

5. Results of Operations, which is where the business has the freedom to summarize the past year, and ends with financial statements.

Once 10K is filed it becomes public information

10K is audited

Information in an Annual Report

1. Primarily for the shareholders.2. The goal is to provide a detailed accounting of your business’s financial health.

3. Detailed financial statements

4. But you’ll also break them down using your own narrative.

You’ll do this through a letter to the shareholders from your CEO, a section with operational and financial highlights and notes that you append to the financial statements.

(Source:finance.Zacks.com, feb. 2019)

10Q?

. Less detail than 10K

. Q stands for Quarter(ly) filing

. 10Q not always audited

8K?

Only with special events

. bankruptcy filing

. acquisition or resignation of a key member of your board of directors

Risk Factors

As an investor, it’s important to know what to look for when you’re reviewing a company’s 10-K. Here are some of the most notable components of a 10-K:- Chairman’s Letter – The chairman’s letter can actually be one of the most telling parts of the 10-K. If possible, gather multiple years of reports and compare what the chairman says from one year to the next. Were they able to accomplish the goals the chairman outlined in a previous year’s letter?

- Risk Factors – Item 1A details the risks a business faces. They’re urged to only list risks that can affect the securities that are being offered. Risks can include lack of an operating history and unprofitable operations in the most previous period.

- Financials – Item 6 will provide a brief overview of the company’s financials over the past five years. If you’re considering investing, this could give you a decent picture of where the company may go in the future.

- Management’s Discussion – Item 7 gives the business the opportunity to offer its own perspective on the previous year’s results. You may also find here a few risks you should take note of before investing.

- Financial Statements and Supplementary Data – Item 8 has all of the appended information you’ll need to get the full picture of how the company performed. This data will have been audited and has the business’s income statement, balance sheets, cash flow statements and the statement of stokholders’ equity.

Databases containing 10K or Shareholder Letters

EDGAR SEC https://www.sec.gov/edgar.shtml

Audit analytics

https://www-auditanalytics-com.vu-nl.idm.oclc.org/ > points to EDGAR

Factset through Screening or Filings?

Source Investopedia

(Source:finance.Zacks.com, feb. 2019)