This post focuses on databases and the availability of the ratio or its components.

Tobin's Q

Market value of assets / replacement value of assets = TQ

or

(Equity Market value + liabilities market value) / (equity book value + liabilities book value) = TQ

On macroeconomic level:

Value of stock market / corporate net worth = TQ

Values larger than 1 say investments have been good.

Datastream:

Datatypes in red can be downloaded (In short: you can calculate the Tobin's Q ratio yourself.)

In Datastream it can be downloaded directly using the following formula

DPL#((X(WC08001) + X(WC03351)) / (X(WC03501) + X(WC03351)),6)

Put this rule in the data types field.

X stands for the selected equity or equities

The WC datatypes are datatypes from the balance sheet (provided by World Scope)

According to the formula liabilities book value and liabilities market value are the same (WC03351) = Total liabillities

Datatypes involved:

WC08001 = market capitalization (annual);

MV = market value

WC03351 = total liabilities

WC03501 = common stock

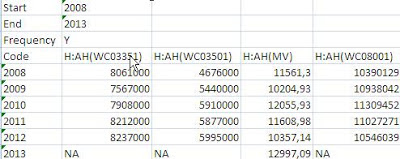

Datastream output:

Tobin's Q can be calculated from the downloaded data.

Using the formula:

DPL#((H:AH(WC08001)+H:AH(WC03351))/(H:AH(WC03501)+H:AH(WC03351)),6)

Other Datastream formula's: (*expression builder/. finder in TSenu)

X(DWEV)/X(DWTA)*1000 (Tobin's Q 2)

(MARKET VALUE OF FIRM AS CAPTURED BY ENTERPRISE VALUE DIVIDED BY BOOK VALUE OF TOTAL ASSETS)

(X(MVC)*1000.000+PAD#(X(WC03451)~PCUR,C)+PAD#(X(WC03251)~PCUR,C)+PAD#(X(WC03051)~PCUR,C))/PAD#(X(WC02999)~PCUR,C)

MARKET VALUE OF EQUITY PLUS BOOK VALUE OF PREF STOCK AND DEBT DIVIDED BY BOOK VALUE OF TOTAL ASSETS

WC03451, WC03251, WC03051, WC02999

Also see: Ratios, values and other instruments from the balance sheet: Datastream

Compustat

Datatypes in red can be downloaded

Market value = MKVALT (North America database)

Calculation: stock price x number of shares (Global database)

Liabilities: LT*

Market value = stock price x number of shares = MKVALT (North America)

Equity book value = Book value per share BKVLPS (North America)

Liabilities book value = Liabilities market value = LT

!! Unfortunately these data can not be downloaded in the Global database !!

Formula North America:

(MKVALT + LT) / (BKVLPS + LT)

Output Microsoft

*) LT

This item represents current liabilities plus long-term debt plus other noncurrent liabilities, including deferred taxes and investment tax credit.

This item is a component of Assets ? Total/Liabilities and Shareholders' Equity ? Total (LSE).

This item is the sum of:

- Current Liabilities ? Total (LCT)

- Deferred Taxes and Investment Tax Credit (TXDITC)

- Liabilities ? Other (LO)

- Long-Term Debt ? Total (DLTT)

AT + (CSHO x PRCC_F) – CEQ / AT >> Total Assets + (Common stocks outstanding x price closing fiscal) – CEQ

(CEQ -- Common/Ordinary Equity – Total) / total assets

Addition Wharton (cop WWU Münster) Data items and ratio's in Wharton

Ratio's, values and other instruments from the balance sheet: Compustat

Amadeus (Bureau van Dijk). (focus on Europe; no banks no financials)

Market value of assets / replacement value of assets = TQ

or

(Equity Market value + liabilities market value) / (equity book value + liabilities book value) = TQ

Total liabilities = Assets - shareholders equity (book value per share x number of shares) = total liabilities

Equity book value: Total Assets - (total) liabilities = shareholders'equity (book value of equity)

Book value per share = Book value per equity / number of shares outstanding

Market value: stock price x number of shares

Amadeus only weekly, monthly and annually

( (stock price x number of shares) + (total assets - shareholder equity) )

___________________________________________________________________________ = TQ

( (book value per share x number of shares outstanding) + (total assets - shareholder equity) )

Also see: Ratios, values and other instruments from the balance sheet: Amadeus

Bankscope (Bureau van Dijk) Focus ob public banks

Search criteria in this example: active, listed, public, commercial banks from Neth, Ger and US

Market value of assets / replacement value of assets = TQ

or

(Equity Market value + liabilities market value) / (equity book value + liabilities book value) = TQ

Number of shares

Book value per share

Total assets

Stock price only weekly, monthy, annually

Market value: stock price x number of shares

Total liabilities = assets - book value per share

Total liabilities = Assets - shareholders equity (book value per share x number of shares) = total liabilities

Equity book value: Total Assets - (total) liabilities = shareholders'equity (book value of equity)

Book value per share = Book value per equity / number of shares outstanding

Tobin's Q:

( (stock price x number of shares) + (assets - book value per share) )

____________________________________________________________________________

( (book value per share x number of shares outstanding) + (total assets - shareholder equity) )

No comments:

Post a Comment