In an ideal world all databases would contain all data and would be fully inter exchangeable.

This post aims an abridged overview of commonly used databases.

I deliberately chose not to focus solely on M&A databases.

Here are some databases.

For database with only publicly listed companies:

date of incorporation (

company age/ company founded) differs often from the

IPO date, the date it went public. As for non public companies: no IPO date until further notice. But company age is retrievable.

Databases particularly concerning: Wharton/Compustat and Datastream (only listed companies)

AMADEUS (more Amadeus tips & tricks: here)

You can't find any data on deal types, IPOs etc. from the start menu.

So first you'll have to construct a workset of companies.

After your selections and opening the list of results, with VIEW list of results . . .

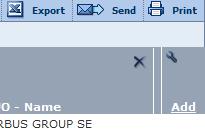

. . . you can use the link

ADD at top right of the screen (image)

A new menu will open.

Note: this principle applies to all Bureau van Dijk databases:

Amadeus, Bankscope, REACH,

Zephyr etc.

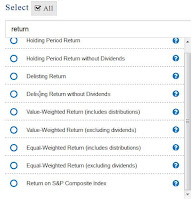

If you can't find the desired data type, you can text search for it.

Give OK.

Joint ventures: a bit hidden

Follow above mentioned method.

Mergers & acquisitions.

Maybe it is sensible to make the selection from the start menu.

ChooseMergers & acquisitions > M &A dels

A new window will open with selection boxes.

As you can see this conditional and focusses on a specific value. In this case, total assets.

Given the time period (-2 years) it ends up with this amount of joint-ventures.

Additional data can be gathered from the list of results.

BANKSCOPE (more bankscope tips & tricks: here)

(OECD countries)

You can't find any data on IPOs etc. from the start menu.

So first you'll have to construct a workset of companies.

On the other hand, there is the option to look for Mergers & Acquisitions

IPO date has to be searched separately: List of results > ADD > type in IPO date

After your selections and opening the list of results, with link

ADD you can add extra data without further limiting your search

DATASTREAM: (for more Datastream tips & tricks:

here)

Date company founded (

WC18272 Static DATA)

(data SHOW as NA not available)

SDC (for SDC tricks and tips see: here)

SDC offers

IPO data.

Global New Issues (GNI)

Settings for this example:

United States, all Public new issues, US common stock, time scope from 3rd January 2000 > on

In the Menu All Items, search words IPO

or browse through TAB Deal. E.g.:

IPO date or IPO flag, select all IPOs.

Nr of IPOs: 3707

Make

Custom Report >

I selected name, issue dates, filing date, offer price, shares offered . . .

date founded

Secondary IPO data: M&A database

Most basic is to search in the menu 'All categories' searching for IPO

Most of presented items open new menu widows enabling to refine your search.

Looking for IPOs of companies involved in mergers and acquisitions is harder.

Maybe the following options is better.

I will stick to a limited set :

Period:01/01/2000

US targets

US acquirors

Deal value: > $ 500M

Deal status: completed

Press Button Execute in the

TOP BAR

Nr of deals: 4006

Two options now:

Using menu, ALL Items, search word IPO >

Many of these IPO data are flags : (Y/N)

Mind: using IPO at this moment will limit your search considerably.

Better is to go to

Custom report.

Again use the ALL Items, search word IPO, but now the data won't influence the size of your work set

After selecting the desired items, click OK > and say NO you don't want to go back select items.

Back in the main Menu. Execute your search.

Joint Ventures

M&A database > select joint ventures

All dates . . . Search all Items: Cross border . Y . . . 8723 hits

Make custom report to add extra data

Company names, name of the joint venture, nation, joint venture flag, status of the alliance . . .

Example.

WHARTON

(TO B

Amadeus

Ownership data : codes.

JO = Joint Venture

Compustat (North America, Compustat Global)

(more Compustat tips & tricks

here)

Pathway:

Choose database > Fundamentals annual > search with CTRL-F: IPO date

WRDS explanation:

This item is the date of a company's initial public stock offering. If

the date of a company's initial public stock offering is not available,

the first trading date in the major exchange is used.

CRSP

According to WRDS support, it should be somewhere under this data item: MSFHDR (stands for monthly security financial header, I believe)

De proper pathway is as follows: CRSP > Stock/ security files > stock header info >

The data items concerned are

Begin of stock data (in output labeled BEGDAT)

End of stock data (in output labeled ENDDAT)

Some additional complications will appear in a few cases when a firm (PERMCO) had multiple securities (PERMNOs). In those cases, you would need to take the oldest BEGDAT and the latest ENDDAT.

ZEPHYR (more Zephyr tips & tricks: here)

Zephyr has a focus on M&A data specifically

World wide and listed and unlisted companies

After your selections and opening the list of results, with link

ADD you can add extra data without further limiting your search

After calling the view list of results and pressing the ADD link, this menu openns, which is devided in deal info, company info and advisor.

As you can see, you can text search info or unfold the categories.

List of results with added data