In finance, a bond is a debt security, in which the authorized (this case government) owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest (the coupon) and/or to repay the principal at a later date, termed maturity. A bond is a formal contract to repay borrowed money with interest at fixed intervals.

So, a bond acts like a loan: the issuer is the borrower (debtor), the holder is the lender (creditor), and the coupon is the interest. Coupon interest is calculated like thus: interest rate / stock value x 100%

Bondholders have a creditor stake in the company, this differs from stock holders, who own a part of the company.Originally, a bond was an actual sheet of paper, consisting of two parts: the coupon, and the scrip. The scrip is the IOU.

Bonds are bought and traded mainly by institutions like central banks, sovereign wealth funds, pension funds, insurance companies and banks. Bonds are used as an alternative to stocks, which are more volatile than bonds (making the latter safer). Stocks yield more than bonds, so when stock trade falls, bonds tend to rise.

There are 2 parts to the bond market: Price and yield. When the Price to buy a share of a bond goes UP, it's yield goes DOWN. (When it's more expensive to buy a share of a bond on the market, sales slow, and the yield goes DOWN.) When the price goes low, yield goes up.

When the open stock market goes down, and there is more supply than demand, the money goes to the paces where there is the most opportunity for stable return, which is the bond market.

(For an easy to read explanation see Mortgage Times blog)

Credit crunch and the EuroWe can see this happing since the start of the credit crunch, when governments started trading bonds.

But the instrument as a safe bet is only partially so.

Fixed rate bonds are subject to interest rate risk meaning that their market prices will decrease in value when the generally prevailing interest rates rise. Since the payments are fixed, a decrease in the market price of the bond means an increase in its yield. Bond prices can become volatile depending on the credit rating of the issuer - for instance if the credit rating agencies like Standard and Poor's or Moody's upgrade or downgrade the credit rating of the issuer (see also: country rating )

A further downgrade could push borrowing costs higher and make it more difficult for governments to meet their debt repayments without seeking help.

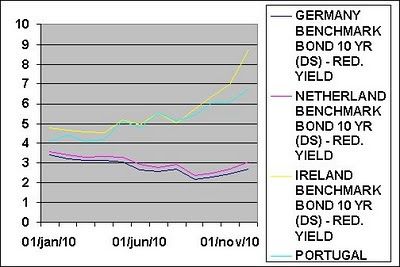

This is happening to countries Ireland and Portugal, lately (2nd half 2010), making it very hard for those countries to issues bonds, since those get a very high 'Redemption Yield' ( the amount of money paid for the stock (price including accrued interest and expenses) and relate this to the future dividend and capital payments, either or both of which may be paid net of tax.)

An example from Datastream

But the Benchmark works with 10y Government Bonds, and those are listed under Interest Rates.

Search using the criteria: name Bond (and market: Portugal) > Portugal Benchmark Bond 10 YR (datastream calculated) > it's only one.

Due to its duration and its widespread usage, the 10-year Treasury note is often used as a benchmark for government bonds overall and is considered a financial benchmark for future economic performance on a larger scale. US treasury started using 10 year bonds. (the rest followed suit?)

To get all benchmark bonds use the text benchmark instead of bond (no market)

Now you can compare between countries using (all 10y)

E.g. Germany, Netherlands, Portugal and Ireland.

More information about this topic can be found at Mark Buyneel's Blog

An overview of databases in University Library VU offering ratings data: click here

No comments:

Post a Comment