Bonds are means of companies of borrowing money. Basically it's an IOU at with agreed percentage interest (not all times)

This post will focus basic and briefly on bond types, issuers and databases at Vrije Universiteit that provide bond data.

Issuer (borrower)

Agencies

These bonds do not include those issued by the U.S. Treasury or municipalities. They include such agencies as Fannie Mae, Freddie Mac, Sallie Mae and the Federal Home Loan Banks.

Corporate (companies)

A corporate bond is a bond issue by a corporation. It is a bond that a corporation issues to raise money effectively in order to expand its business

Sovereign (governments)

A government bond is a bond issued by a national government, generally with a promise to pay periodic interest payments and to repay the face value on the maturity date.

Financial Institution ((investment)banks, insurance companies)

In financial economics, a financial institution is an institution that provides financial services for its clients or members.

Supranational

An international organization, or union, whereby member states transcend national boundaries

Bond types

With warrant

In finance, a warrant is a security that entitles the holder to buy the underlying stock of the issuing company at a fixed exercise price until the expiry date, and that can be profitable. Warrants are often connected to bonds or preferred stock to draw extra investors, allowing the issuer to pay lower interest rates or dividends

Convertible

A convertible bond or convertible note is a type of bond that investor can convert into a specific number of shares in the issuing company or into cash of equal value. It is a possesses debt- and equity characteristics.

See also: this Wikipedia < - link

Floating rate

Floating rate notes (bonds) are bonds that have a variable coupon, following money market rates, like LIBOR or federal funds rate, plus a quoted spread (a.k.a. quoted margin). The spread is a rate that remains constant. Most often short term. In the U.S., government sponsored enterprises are important issuers. In Europe the main issuers are banks.

Straight

A bond that pays interest at regular intervals, and at maturity pays back the principal sum that was originally invested (interest and money back). Straight bonds are debt instruments because they are essentially loaning money (creating debt) to an entity, IOU.

Zero coupon

Zero-coupon bonds (discount bond) is a bond bought at a price lower than its face value, with the face value paid back at the time of maturity. It does not make periodic interest payments, or have so-called "coupons", hence the term zero-coupon bond.

(Sources: Wikipedia and Investopedia)

Comparison

Taken from Q&A in WRDS:

Do TRACE and FISD contain all bonds covered in Datastream?

How do Datastream, TRACE and FISD compare relative to each other in terms of bond coverage?

Note: FISD (Mergent) < no subscription at VU

1. TRACE is based on intraday trading reports from bond brokers.

Also read this < - link

TRACE does not contain all bonds available in Datastream because of the time coverage and the country scope and the focus of TRACE is on bond trades information, not on bond characteristics.

2. Datastream

Regarding Datastream, this product is currently not offered through the WRDS system. It covers many countries and includes information on dead bonds, has individual bonds issued back in 1990s, and you also may find some thirty-year benchmark bonds issued back in 1970s or 60s. For third-party bond indices, history varies, but for Datastream Global Government Bond indices, the history goes back to late 1980s.

Also see this page < - link

Wharton database TRACE < - see also this blog page

Datastream

Beginning: (simple search)

Start up Excel > Click TAB Datastream > choose from the menu on the left either Static Search (for work sets) or Time series (financial data) > Press link : Choose a single category and select

Bonds & convertibles

The next screen looks something like this:

You can further narrow with the filter menu on the left hand side:

Filters used: Market: international > type: bond > Issuer type: corporate >borrower: heineken: end result

22 bonds

Select all > click link USE (which lights up when you select any bond)

Back in the menu, now it's time to search for the datatypes (orange button > providing the data)

This example: static search, hence static datatypes

Note: make certain when looking for bonds data, to use the bonds data types (mouse over at top Data Category)

It's always recommended to reset your screen to remove any possible filters. (button at top right)

There are 223 static datatypes. You can further narrow with e.g. pressing link key datatypes in the menu on the left. Those are the key static datatypes.

Note clickable field static.

Select all in field above the selection squares, and press use selected.

Back in the menu.

Now it's time to decide whether to transpose and/ to embed (don't since we are searching static data)

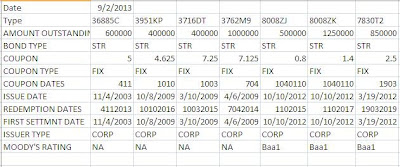

Possible Output:

Any datatype that isn't subscribed does not provide data

(message: ERROR, invalid code or expression, you don't have access)

NA means not available (read . . . "yet" or "anymore")

Output example Static.

Same bonds in a Time Series with key datatypes

A very clear blog item on issuer types and where various kinds of bonds can be found in Datastream can be found here. < - click link

No comments:

Post a Comment