This post aims to show a handful options to retrieve macro economic data.

Shown are examples from IFS, World Bank open data, UN Monthly bulletin of statistics, Eurostat and Datastream.

For Example: Interest rates.

Generally Government Bonds asre considered Risk Free investments (high guarrantee of money back, plus interest) The interest is considered the general inerest rate of any given country. The higher the interest a country has to pay when a bond matures, the riskier the investment is considered. Country ratings by the rating agencies like Moody's, Fitch en Standard & Poors are based on this concept.

IFS (International Financial Statistics - IMF)

Is, when you know the route, actually very simple.

- Choose Data Source

- IFS

Select Country

This table shows exchange rates, interest rates (T-Bills, or risk free) , GDP etc.

World Bank (open data)

Starting page.

By country opens the option for an interactive map. (e.g. China)

Steps: by Country > select country name > (scroll down until )

Also optional is is Button Development Indicators.

Next > Data Bank (annuals)

The Link Indicators provides 5 yr figures

The option By topic:

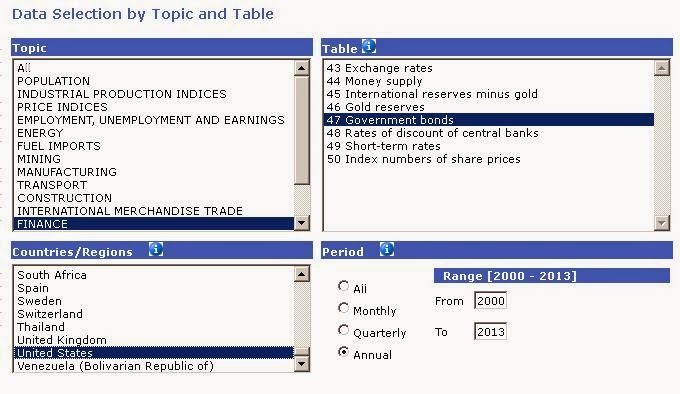

United Nations Monthly Bulletin of Statistics

Most selections can be made here.

Results

Eurostat (EU)

Results

Datastream

(assuming you are familiar with Datastream, otherwise I refer to these pages = all my blog items dfealing with Datastream)

Method: I'll be searching for the 10y Germany benchmark bond, which represents the interest rate.

Selecting Interest rates Advanced Criteria Search

- interest rates

Criteria search Germany benchmark

Results

You can also use the Free Text search

Search term benchmark and then select interest rates (you can play with this)

Next select Germany. As you can see the 10y bonds are already presented.

The rest is the same as in tyhe advanced example.

Another way of retrieving the interest rates is to work with Bond Indices (risk free).

Example is through the Free text Search.

Results.

No comments:

Post a Comment